Trump and his allies are doing their donors’ bidding (open bribery) by rigging a $4 trillion giveaway to wealthy elites —while preparing cuts to programs that working and middle-class US Americans depend on.

from NewsWire by Americans for Tax Fairness at Common Dreams 7/12/24 .….via thefreeonline at https://wp.me/pIJl9-Ff7 Telegram t.me/thefreeonline

Intro by thefreeonline

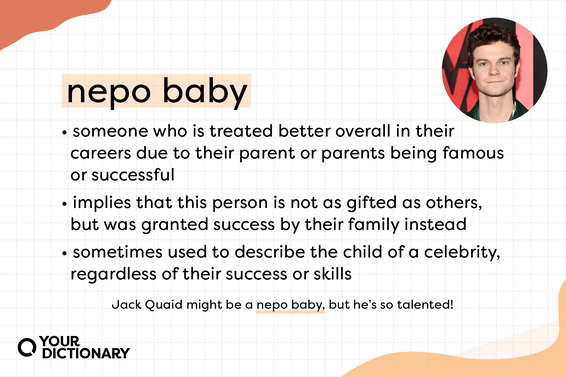

IT’S NOT FAIR.. screamed little Bill the nepo-billionaire when Bob got the cherry on the cake

Its not your fault if you were born into a US Billionaire family.. But later you’re likely conditioned into being a monster.

The Fairness Report is only about US Americans and how they could revel in a Tsunami of Dollars if the Billionaires were taxed ‘fairly’.

But of course the USA is a Mafia State, pulling in trillions of dollars from the other ‘would-be’ mafia States by means of its military and financial control..

The rest of us just don’t matter to conditioned monsters.

We don’t matter even to the ‘fairness advocates’ of the Report. US folks are steeped in a culture of privilege, especially for the ‘white’ race and those privileged who are already nepo-rich.

A privilege which has hardly ever reached the workers, and is now fast fading, as the US Israeli-backed Corporate Ecocidal War State splurges its ill gotten gains, indulges in Humongous Debt, and lavishes the spoils on its 0.1% of Billionaires.

Of course most capitalist States might be just as bad if they had ‘Hegemoney’

***********

Americans for Tax Fairness released a new report detailing some key beneficiaries of the Trump tax policies: billionaire nepo-babies.

Alongside cheeky profiles of inheritors wasting family fortunes on failed vanity businesses, medieval church purchases, lifestyle brands, private jets, and more, the report examines the startling realities of billionaire wealth growth.

Example: 30 of the largest billionaire dynasties have seen their fortunes swell by 54% over the past nine years, while the wealth gap between the top 0.01% and bottom 90% has reached its highest level since the Great Depression.

‘Nepo Babies’ Explained: What They Are, and Why Everyone’s … – CNET/… nepo babies don’t always lack talent, but there’s no doubt their membership in the Lucky Sperm club eased their way into a predator field

Even more damning than the frivolous use of wealth, the report reveals how inheritors have spent vast sums over decades to elect politicians who protect their unearned wealth and manipulate the country’s economy in their favor.

“The vast wealth inherited by sometimes centuries-old billionaire families is staggering. While these heirs and their billions go undertaxed, enormous sums are squandered on lavish mansions, private jets, and vanity projects instead of funding crucial public investments,” said David Kass, ATF’s Executive Director.

“In 2024, these billionaire families used their enormous wealth to make record-breaking political contributions to secure a GOP trifecta. Now, Trump and his allies in Congress are doing their donors’ bidding by rigging the system in their favor and pushing a $4 trillion giveaway to wealthy elites and giant corporations—all while advocating for cuts to vital programs that working and middle-class Americans depend on.”

Report Highlights:

- Nepo babies profiled: Wyatt Koch, Sam Logan (of the Scripps family), Timothy Mellon, Nicola Peltz-Beckham, Gabriel Rubenstein, Eric Trump

- Forbes 400 wealth growth is almost 10 times greater than bottom 90% of families since 1982

- Wealth gap between top 0.01% and bottom 90% reaches highest level since Great Depression

- 150 billionaire families have spent a record $1.9 billion on 2024 election legal bribery—a figure that will increase once final numbers are reported

- If all the loopholes were closed, the current estate tax on billionaires and centimillionaires would yield enough for free childcare, preschool, and paid family leave with hundreds of billions left over.

Americans for Tax Fairness (ATF) is a diverse campaign of more than 420 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans.

It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules. (202) 506-3264

www.americansfortaxfairness.org Contact: Pwillis@americansfortaxfairness.org