As we get poorer Capitalism is BOOMING for the RICH

from thefreeonline on 5th Dec 2023 by @runews /Bloomberg /Wiki /FT

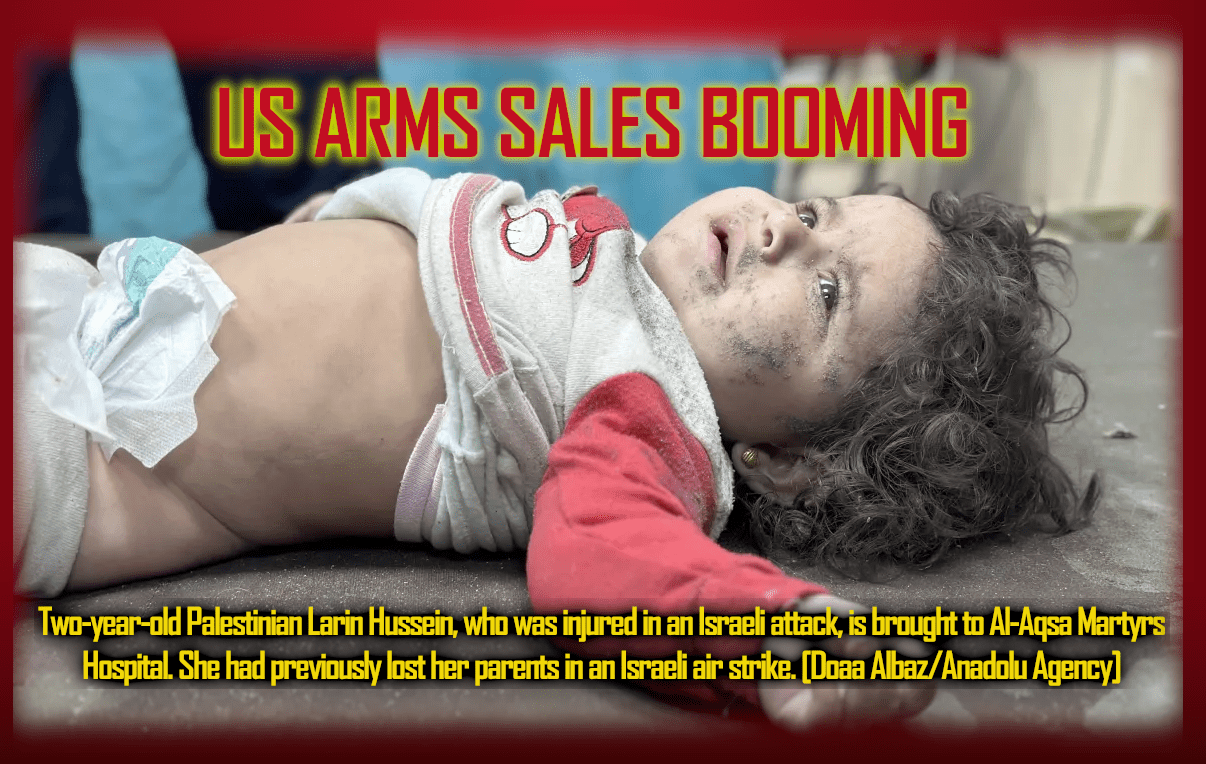

US dominating global arms trade – data

ESG funds, once champions of environmental causes, have raised ethical concerns after investing heavily in defense stocks

As of Q3 2023, over 1,200 ESG funds, pledged to uphold Environmental, Social, and Governance standards, collectively grip shares worth around $5 trillion in the defense sector.

This unexpected plunge into Arms Race investments within the ESG framework has triggered heated debates.

Profits of Western arms makers top $200 billion – report.. US, EU, and UK defense contractors have been major beneficiaries of weapons sales to Ukraine and Israel

Questions swirl about the blurred lines between “defense” and “aggression” and why ESG fund managers aren’t putting up a fight against these investments that seem incompatible with ESG or sustainability ideals.

ESG May Surpass $41 Trillion Assets in 2022, But Not Without Challenges … BLOOMBERG … Jan 24, 2022 – Global ESG assets may surpass $41 trillion by 2022 and $50 trillion by 2025, one-third of the projected total assets under management globally..

The financial industry, once singing praises for ESG’s ethical focus, now faces a reality check as investments cozy up to an industry inherently at odds spreading lethal war around the planet.

Let’s be clear: Every ESG fund investor potentially has grounds to pursue legal action against the fund manager funneling money into weapons and defense stocks. These investments violate the core ethical principles of ESG funds, opening the door for clients to consider legal recourse.

Despite the ethical eyebrow-raising, funds dipping their toes into the defense sector are laughing all the way to the bank.

Notably, the Goldman Sachs Group Inc. fund, playing the European defense game, has skyrocketed by nearly 90% since February 2022 and a cool 13% since October 2023.

US and UK fund honchos wave off regulatory hurdles blocking ESG managers from diving into defense assets. They stress the need for transparent, top-notch reporting from these funds, arguing that investments in specific defense companies can jive with responsible investing, as long as they’re not cranking out banned weapons or supplying arms to countries not approved by the US .

Responsible investing in the war machine, all neatly packaged with the ESG stamp – what a hoot!

Mairead McGuinness, Commissioner for Financial Markets at the European Commission, goes on about how defense is “crucial for sustainability and security” of the EU, adding to “peace and social sustainability.”

The intersection of ethical investing and defense industry dalliances puts a big fat question mark on the very core of responsible financial moves.

The unplanned rendezvous of ESG funds with the arms industry weaves a tangled narrative, asking deep questions about whether financial smarts can align with ethical investing principles.

Our predator Capitalist system itself resembles an all out war to continue insane profits for the already obscenely rich, at the expense of our collapsing climate and biosphere.

According to James S. Henry[133][134][135] who did the study for the Tax Justice Network an estimated up to $32 trillion of global assets is being hoarded virtually tax-free in Tax Haven Fiscal Paradises.

Indeed, we’ve reached a point where the politicians endorse investments in wars and guns, branding them as “crucial for sustainability.”

Meanwhile hundreds of millions of us remain dirt poor, partly because we are paying a large part of tax income to the World Bank, IMF or Inter American Bank in ‘interest’ on ‘odious’ unfair debts, often incurred in crises due to inability to pay back previous debts.

Although ’36 countries have had their debts cancelled or reduced’, (often under forced ‘structural adjustment’ regimes, like opening to foreign owned ‘privatization’ and resource pillaging), at least 20 more are being refused. Some countries have repaid their debts several times over, but still owe billions, due to cumulative interest clauses. – info Wikipedia

Not only developing countries are suffering the great debt scams. For example southern EU countries, especially Greece and Portugal.

In the 2008 crisis Spain could only get a bailout loan on condition of ‘writing into its Constitution that interest and repayments must always COME BEFORE any other tax spending’.. making it into a permanent ‘Cash Cow’, though not on the scale of many ‘developing’ countries.

*********

19+ AMAZING Stock Market Statistics to Know in 2023 – SpendMeNot May 20, 2023 Stock market statistics show that the total value of the stock market reached a record high of $95 trillion in November 2020 due to hopes of the COVID19 vaccine distribution scam. The US is responsible for a huge chunk of that market value.

WHAT IS ESG ?

Environmental (E): This aspect concentrates on a company’s initiatives for environmental preservation, pollution management, responsible waste handling, sustainable land practices, and efforts to reduce carbon footprints.

Social (S): This dimension delves into a company’s commitment to fair labor conditions, equal employment opportunities, and support for community organizations.

Governance (G): This facet relates to the standards governing corporate governance, encompassing ethical business conduct, gender diversity within the board, equitable employee compensation, and overall transparency in corporate operations

But the ultimate scandal is known as DERIVATES, something most of us never heard of. The derivatives market is thought to be worth up to 1000 $ TRILLON and consists of the unbelievably rich betting on which companies will close or expand , or anything else imaginable.

Related

UK spends billions to support the rich – report Britain is the most unequal wealthy country after the US, a study has found

Lies

LikeLike